- 2023 State of Preschool Annual Yearbook (NIEER)

- 2023 State Profiles, State of Preschool Annual Yearbook (NIEER)

- 2023 State Pre-K Eligibility Levels

- 2023 Percentage of Preschool Children in State Preschool

- 2023 Preschool Spending by State

- 2023 State Supplemental Funding for Head Start and/or Early Head Start

- 2022 State of Preschool Annual Yearbook (NIEER)

- 2022 State Profiles, State of Preschool Annual Yearbook (NIEER)

- 2021 State of Preschool Annual Yearbook (NIEER)

- 2021 State Profiles, State of Preschool Annual Yearbook (NIEER)

- 2020 State of Preschool Annual Yearbook (NIEER)

- 2020 State Profiles, State of Preschool Annual Yearbook (NIEER)

- Dr. James Heckman, the Heckman Equation (Return on Investment)

- Dr. Tim Bartik, Investing in Kids (Return on Investment)

- Meta-analysis on Early Learning Evaluations

State Pre-Kindergarten Programs

National Assessment of Educational Progress (2022 & 2019 Report Results)

- 2022 NAEP main site

2022 NAEP 4th grade reading results: by Race & Ethnicity, by Free & Reduced Price Lunch vs Not Eligible for FRPL, U.S. and States overall - 2019 Nation's Report Card Main Site

- 2019 4th & 8th Grade Math & Reading Results by category

- 2019 State Profiles: Reading

- 2019 State Profiles: Math

- 2019 District Profiles (Large Metro)

Race to the Top Early Learning Challenge Grant Background

Federal Budget Issues

Source: Division H- FY2016 Departments of Labor, HHS and Education and Related Agencies, contained in the Consolidated Appropriations Act of FY2016.

Note: *With regard to the Head Start increase of $576 million, $429 million of that funding goes for competitive expansions to full day programs ($294 million) and an increase of $135 million for Early Head Start (including EHS/Child Care partnerships).

To read the House Majority Summary of the 2016 Consolidated Appropriations Act, click here. To read the House Democratic summary, click here.

Other Related Budget Background

- HHS, Office of Child Care

- FUNDING

- FY2024 CCDBG Allocations

- FY2023 CCDBG Allocations

- FY2022 CCDBG Allocations

- FY2021 CCDBG Allocations

- FY2020 CCDBG Allocations

- CHILD DATA

- FY2021 CCDBG Statistics

- FY2020 CCDBG Statistics

- FY2019 CCDBG Statistics

- FY2018 CCDBG Statistics

- FY2017 CCDBG Statistics

- FY2016 CCDBG Statistics

- FY2015 CCDBG Statistics

- FY2014 CCDBG Statistics

- EXPENDITURES

- CCDBG Expenditure Data by State

HEAD START & EHS DATA

- HHS, Office of Head Start

- Head Start Program Stats (National, 2023)

- Head Start Program Stats (All States, 2023)

- Head Start Program Facts: Fiscal Year 2023

- Head Start - (PIR) Staff Qualifications Report (States 2022)

- Head Start Law –PL110-134, “Improving Head Start for School Readiness Act of 2007”

- Head Start Performance Standards

- Head Start Program Instructions (PIs)

- Head Start Information Memorandums

- Getting Ready for Kindergarten: Children's Progress During Head Start - FACES 2009 Child Outcomes Report

- Office of Head Start Tribal Report

- Early Head Start

- Early Head Start/Child Care Partnerships

- National Head Start Association

The Protecting Americans From Tax Hikes Act of 2015

Another end of the year bill, The Protecting Americans From Tax Hikes Act of 2015, includes changes to the tax code which are estimated at losing about $623 billion over the next 10 years. Some of the provisions make sections of the current tax code permanent (instead of allowing them to expire), some make modifications, and some repeal some sections of the code.

- House Ways & Means Committee Section by Section describing the tax bill

- Joint Tax Committee’s revenue estimates

FY2016 Federal Budget

2016 First Continuing Resolution (Expired December 9, 2016):

On September 28, two days before the end of the fiscal year, Congress approved a Continuing Resolution (CR) to continue federal funding through December 9, 2016 (P.L. 114-223). A 10 week CR was necessary because the fiscal year ended September 30th and Congress was scheduled to adjourn (i.e., recess through the November elections). Funding was largely continued at FY2016 levels (a freeze) until final determinations can be made in December. Note: An across-the-board spending reduction of .5% was applied in order to keep spending below budget caps.

Joint Tax Committee Revenue Estimates

FY2017 Continuing Resolution (PL114-254), Expired April 28, 2017. Congress adjourned in December 2016 without passing a full year continuing resolution (CR). Instead, a short-term continuing resolution funding the government through April 28, 2017 was enacted. In order to stay within budget caps enacted as part of the 2015 budget law, a .19% across the board cut was applied.

- Text of the Continuing Resolution (PL114-254)

- CR Summary (House Appropriations Committee)

- CR summary (Rep. Nita Lowey (D-NY), Ranking Member House Appropriations Committee

FY2017 Federal Budget

FY2017 Omnibus Appropriations Act (PL115-31) was enacted on May 4, 2017.

- FY2017 Omnibus Appropriations Act Summary/Press Release

- Summary of the FY2017 Labor, HHS, and Education section of the Omnibus

- A more detailed document is contained within Division H, here.

- Text of FY2017 Omnibus

- FY2016 Consolidated Appropriations Act. The FY2016 Consolidated Appropriations Act (P.L. 114-113) is a $1.15 trillion package of year-end appropriation bills. Within this measure is funding for the FY2016 Labor, HHS and Education programs, which received an increase of $5.4 billion compared to FY2015. Programs under the Department of Health and Human Services, Administration for Children and Families, received an increase of $1 billion (primarily for the Child Care and Development Block Grant and Head Start).

- FY2016 Labor, HHS and Education Committee Report Text

- Summary: FY2016 Consolidated Appropriations Act Summary for Key Early Childhood & Family Programs and Tax Provisions Affecting Families in Dec. 2016 Tax Bill

FY2018 Senate Labor, HHS and Education Appropriations bill: On September 7, the Senate Appropriations Committee approved the FY2018 Senate Labor, HHS and Education Appropriations bill. For early learning programs, both the Child Care and Development Block Grant (CCDBG) and Head Start were frozen at FY2017 funding levels. For more information, see the bill summary, the bill text, and the Committee report.

Past Continuing Resolutions for FY2018

P.L. 115-123 was enacted to continue government operations from 2/8/18 - 3/23/18. P.L. 115-120 was enacted to continue government operations from 1/22/18 – 2/8/18. P.L. 115-96 was enacted to continue government operations from 12/22/17 – 1/19/18. P.L. 115-90 was enacted to continue government operations from 12/8/17 – 12/22/17. P.L. 115-56 was enacted to continue government operations from 9/8/17 – 12/8/17.

- HHS, Office of Family Assistance

- FY2023 TANF Expenditures

- FY2022 TANF Expenditures

- FY2021 TANF Expenditures

- FY2020 TANF Expenditures

- FY2020 Federal TANF and State MOE Spent on Child Care (National)

- FY2020 TANF Transferred to CCDBG by State

- FY2020 Federal TANF Expenditures on Child Care and Pre-K by State

- FY2020 State TANF MOE Expenditures on Child Care and Pre-k by State

- FY2020 All TANF Expenditures by State including MOE

- FY2019 TANF Expenditures

- FY2018 TANF expenditures

- FY2017 TANF Expenditures

- FY2016 TANF Expenditures

- FY2015 TANF Expenditures

- FY2014 TANF Expenditures

- FY2013 TANF Expenditures

- FY2012 TANF Expenditures

- FY2011 TANF Expenditures

- FY2010 TANF Expenditures

- FY2020 - FY2010 Summary All Child Care Data

P.L. 115-141 was enacted on March 23, 2018 to fund government operations through September 30, 2018 (the end of fiscal year 2018).

FY2018 Budget

On September 18, 2018 the Senate approved HR 6157, the “minibus” reflecting a combined FY2019 Department of Defense and Labor, HHS, and Education appropriations conference report by a vote of 93-7. The measure also included continuing funding authority through December 7, 2018 for annual appropriations bill not yet approved.

TANF Budget Background

FY2019 Budget

FY2020 Omnibus Appropriations

On December 20, 2019, the FY2020 non-defense consolidated appropriations bill (HR 1865, PL116-94) was signed into law containing 8 appropriations bills including the FY2020 Labor, HHS, and Education Appropriations measure and a revenue package. The FY2020 defense and related agencies consolidated appropriations bill (HR 1158, PL116-93) was also signed into law on December 20.

- Text of HR 1865, the non-defense consolidated appropriations bill (PL116-94)

- Committee report description of the provisions contained in the FY2020 Labor, HHS and Education section (referred to as Division A)

- Section by Section Summary of the Consolidated Appropriations Measure (PL116-94)

- Joint Tax Committee Estimate of Tax Package: "Estimated Budget Effects Of The Revenue Provisions Contained In The House Amendment To The Senate Amendment To H.R. 1865, The Further Consolidated Appropriations Act, 2020"

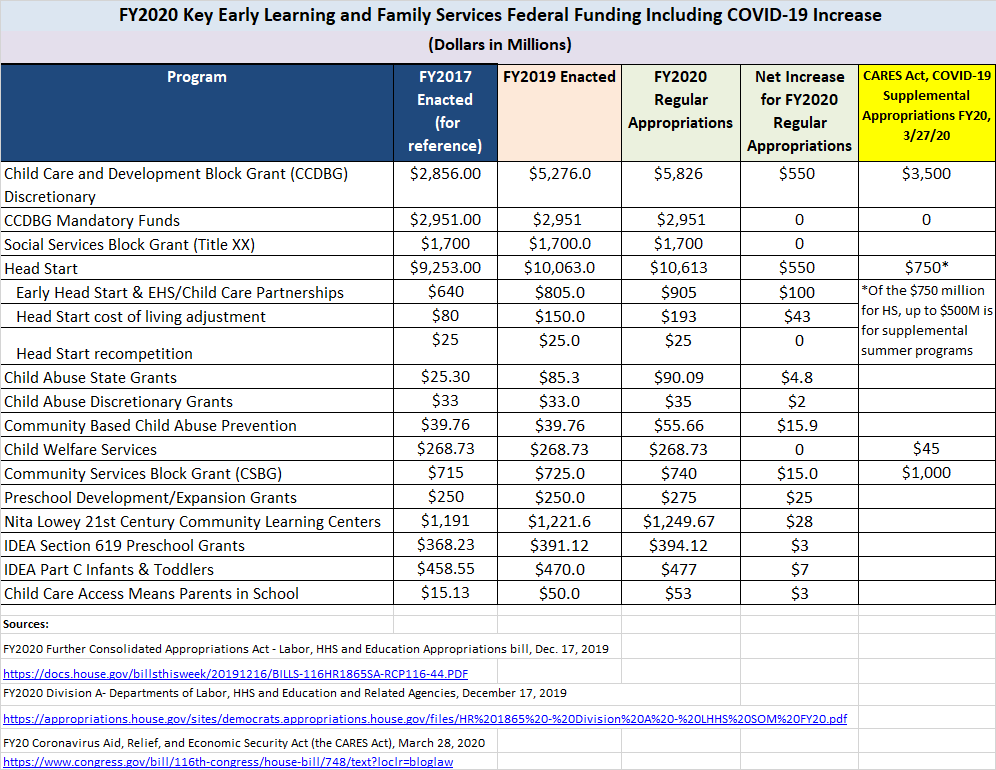

The CARES Act. In March of 2020, Congress passed three major bills that were signed into law to address the COVID-19 national emergency.

Each of these measures seeks to provide assistance to individuals, families, and businesses as the nation weathers the impacts of COVID-19. Texts and summaries of these bills are to the right.

Funding for programs included in the CARES Act signed into law on March 28, 2020 related to child care are listed below. More information related to COVID-19 and assistance available to parents, employers, and communities is located on Early Learning Policy Group's COVID-19 resource page.

COVID-19 Congressional Action in Brief:

The FY2021 Consolidated Appropriations and COVID-19 Emergency Relief Act (December 27, 2021, (P.L. 116-260)

- Summary of FY2021 Appropriations

- Summary of the COVID-19 Relief Provisions

- Division H - Departments of Labor, Health and Human Services, and Education Appropriations Explanatory Statement

- Summary of Authorizing Statutory Changes

COVID-19 Relief: Child Care Funding Increase ($10 billion)

- Child Care Statutory Language (December 27, 2020)

COVID-19 Relief: SBA Paycheck Protection Program & EIDL

- Summary of the SBA provisions by the House Small Business Committee (December 27, 2020)

- Section by Section of the PPP and EIDL provisions (December 27, 2020)

COVID-19 Relief: Unemployment Compensation

- Unemployment Extension & Modification Summary by the House Ways & Means Committee (December 27, 2020)

COVID-19 Relief: Tax Extenders

- Summary of Tax Provisions (December 27, 2020)

- Joint Tax Committee Revenue Estimates (December 27, 2020)

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, March 27, 2020, (P.L. 116-136)

- Senate Appropriations Committee Appropriations Summary (March 25, 2020)

The Families First Coronavirus Response Act (FFCRA), March 18, 2020, (P.L.116-127)

- House Appropriations Committee Summary (March 16, 2020)

Fiscal Year 2020 Coronavirus Preparedness and Response Supplemental Appropriations Act, March 6, 2020, (P.L. 116-123)

- Senate Appropriations Committee Summary, March 4, 2020

The latest on the Federal Budget:

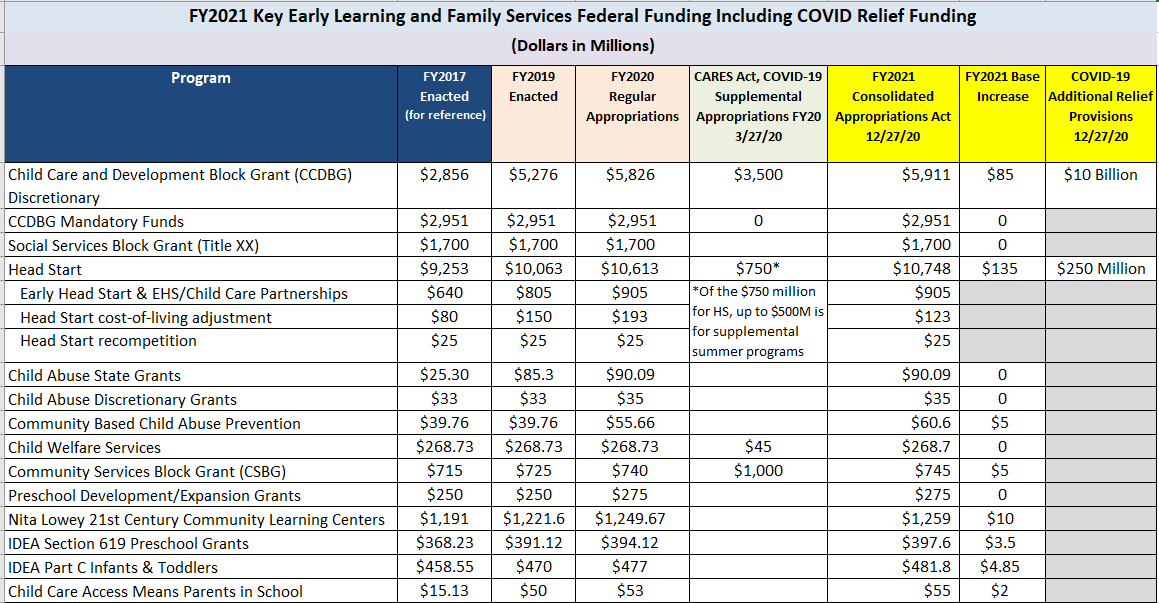

On December 27, the FY2021 Consolidated Appropriations Act (P.L. 116-260), a 5,593 page bill that included appropriations for federal funding for FY2021, a broad-based COVID-19 emergency relief package, and various tax extenders (some of which were related to COVID-19 emergency relief and some were tax provisions set to expire) became law.

Funds for key early learning and family services programs are listed below, which includes base funding for FY2021 as well as additional increases in funding for child care and Head Start programs provided as part of emergency COVID-19 relief.

Schoolhouse Rock Update

- FY2022 Consolidated Appropriations Act, bill text

- Division H - Departments of Labor, HHS, and Education FY2022 Consolidated Appropriations Act, Explanatory Statement Report

- FY2022 Consolidated Appropriations, Community Project Funding

- FY2022 Consolidated Appropriations, all committee reports

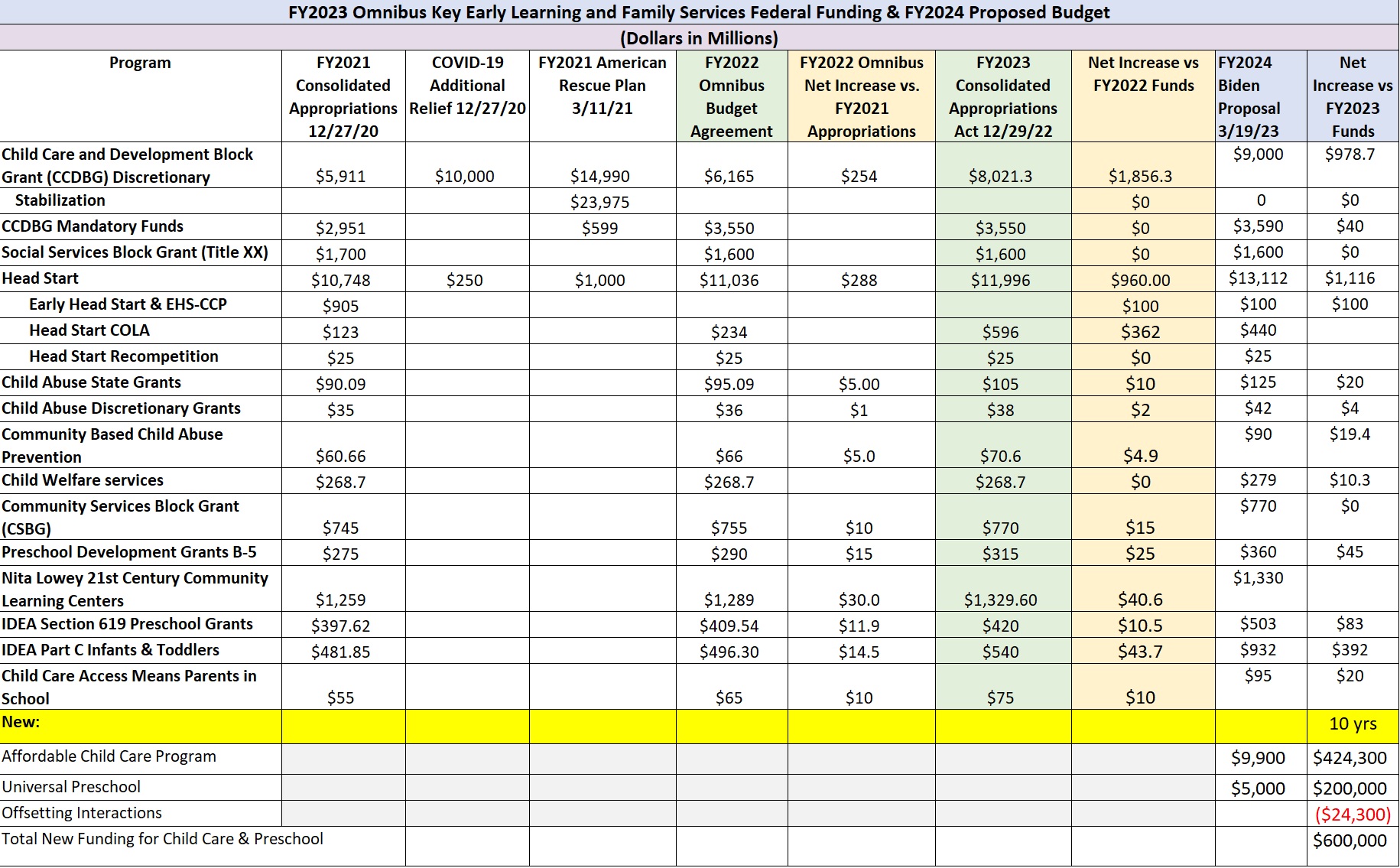

On March 15, 2022, HR 2471, the FY2022 Consolidated Appropriations Act became law (P.L. 117-103).

FY2021 Appropriations

On December 29, 2022, the FY2023 Consolidated Appropriations Act became law (P.L. 117-328). On March 9, 2023, President Biden proposed the administration's budget for FY2024.

FY2022 Appropriations

- FY2024 Further Consolidated Appropriations Act, bill text

- Division D - Departments of Labor, HHS, and Education FY2024 Further Consolidated Appropriations Act, Explanatory Statement Report

- FY2025 President Biden HHS Congressional Justification Background Report

FY2023 Appropriations

- FY2023 Consolidated Appropriations Act, bill text

- Division H - Departments of Labor, HHS, and Education FY2023 Consolidated Appropriations Act, Explanatory Statement Report

- FY2023 Consolidated Appropriations, all committee reports

- FY2024 President Biden HHS Congressional Justification Background Report

Source: FY2024 Further Consolidated Appropriations Act, P.L. 118-47 (March 23, 2024)

Funding for FY2025 is currently operating on a short-term continuing resolution through March 14, 2025. Congress extended funding through the American Relief Act on December 21, 2024 (P.L. 118-158). As part of the CR, child care funding was increased by $250 million related to federally declared disasters in 2023 and 2024. In addition, CCDBG discretionary funding (awarded to all states and territories) was increased by $250 million.

Stay tuned for full year appropriation updates.